Millions of millennials

The millennial generation – also known as Generation Y – includes people born between 1980 and 2000. Most are now adults and in the workforce. There are about 81m millennials in the US – more than a quarter of the total population, and they now out number Baby Boomers, their parents’ generation.

For marketers, especially in fintech, crafting strategies towards millennials is becoming increasingly important. While primarily addressing marketing directly to their consumers, businesses can also benefit from understanding the influencers of millennial age working in their own companies.

Reaching hyper-connected millennials – beyond basic marketing strategies

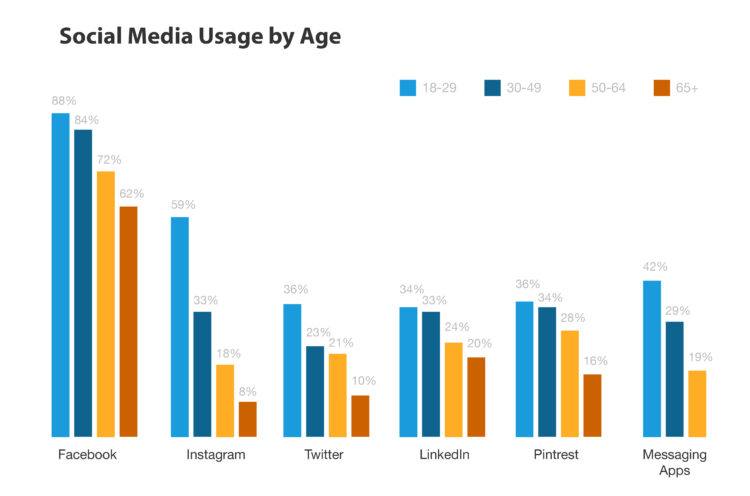

One of the key factors that set millennials apart from other generations is their adaptation of technology into their everyday lives. They are hyper-connected: disproportionately drawn to mobile and wearable devices for their day-to-day needs; far more likely to make purchases on them instead of computers or in person; and constant users of social media.

[Source: Pew Research Center, Social Media Survey, April 2016]

This creates a wealth of opportunities for marketing efforts that go beyond more traditional digital marketing channels – including paid search and SEO, which nonetheless should not be abandoned – to reach millennials on the electronics they take with them everywhere, every day. (A study done in 2014 by SDL found that millennials check their phones and average of 43 times per day.)

B2C

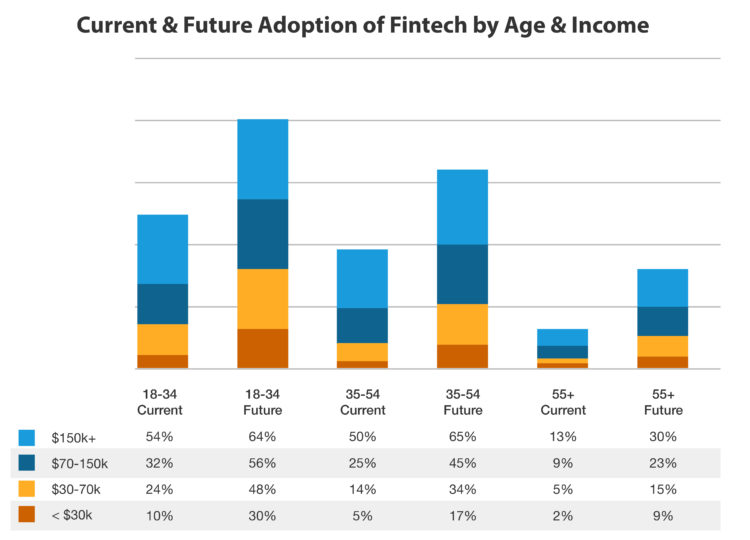

[Source: EY, EY Fintech Adoption Index, 2016]

Not only are millennials more likely than Gen X’ers and Baby Boomers to use fintech products now, they are expected to use them even more in the future. Not surprisingly, in all cases greater income correlates to greater use of fintech products.

Scratch’s 2017 Millennial Disruption Index reveals that millennials see more change on the way:

- 68% say that in 5 years, the way we access our money will be totally different

- 70% say that in 5 years, the way we pay for things will be totally different

- 73% would be more excited about a new offering in financial services from Google, Amazon, Apple, Paypal or Square than from their own nationwide bank

- 33% believe they won’t need a bank at all in 5 years

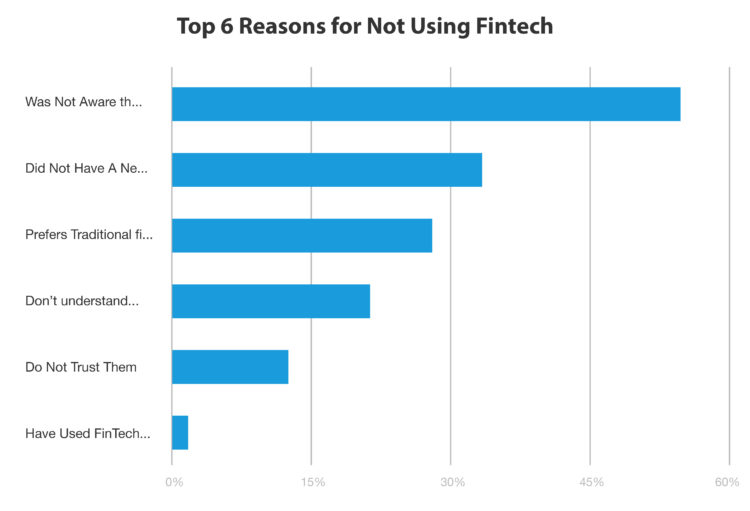

Challenges of marketing fintech solutions

Not all millennials embrace fintech products and services, of course. But since the greatest obstacle to overcome is a lack of awareness that such solutions exist (see below) a clear opportunity presents itself for businesses to build brand and product awareness and help their audiences understand what benefits they can receive.

[Source: EY, EY Fintech Adoption Index, 2016]

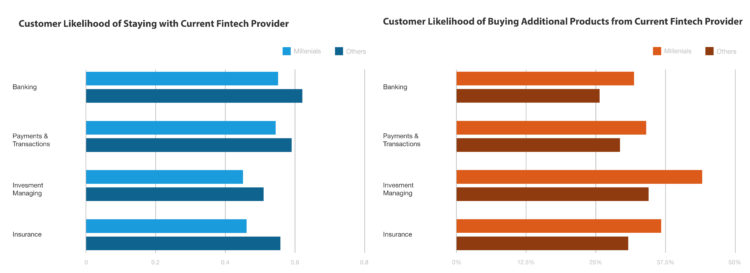

[Source: CapGemini, World Fintech Report, 2017]

Although less likely than other generations to stay with their current fintech firms, millennials are more likely to buy additional products from them. This suggests that while product awareness and information are important for top-funnel marketing efforts, lead nurturing, community management, and content marketing will be increasingly important for bottom-funnel marketing efforts.

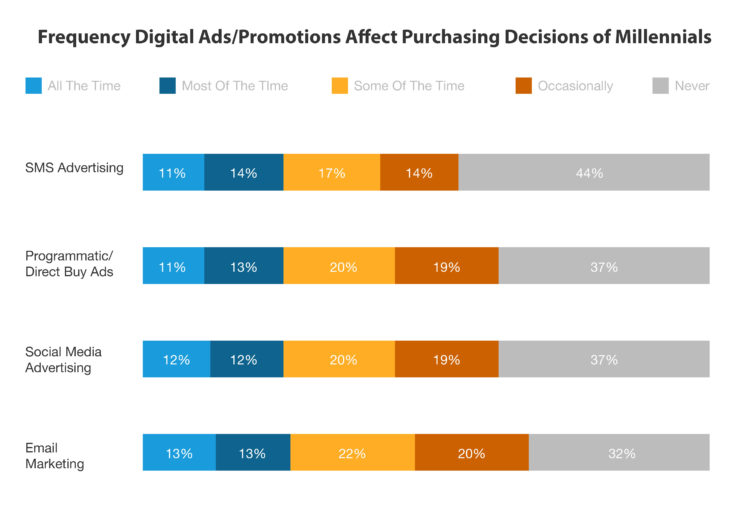

[Source: Fluent, Marketing to Millennials, August 2016]

Millennials’ purchasing decisions are heavily influenced by non-traditional, modern digital marketing tactics:

- 66% are affected by SMS ads

- 63% are affected by social ads

- 68% remain influenced by email

- 66% remain influenced by programmatic and direct buy ads

[Source: PwC, The Say The Want a Revolution: Total Retail, February 2016]

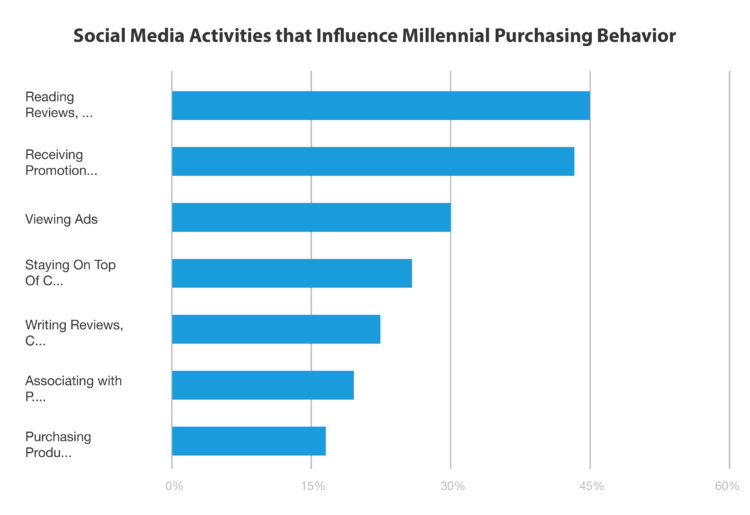

A combination of advertising, promotions, and online community has a strong influence on millennials’ purchasing behavior. Although awareness and lead generation campaigns can still be effective, millennials also look for reviews, comments, and other content that will help them trust the brand. Elite Daily’s Millennial Consumer Study (January 2015) supports this:

- 33% say they read blogs before making a purchase

- 62% say that if a brand engages with them on a social network, they are more likely to become a loyal customer

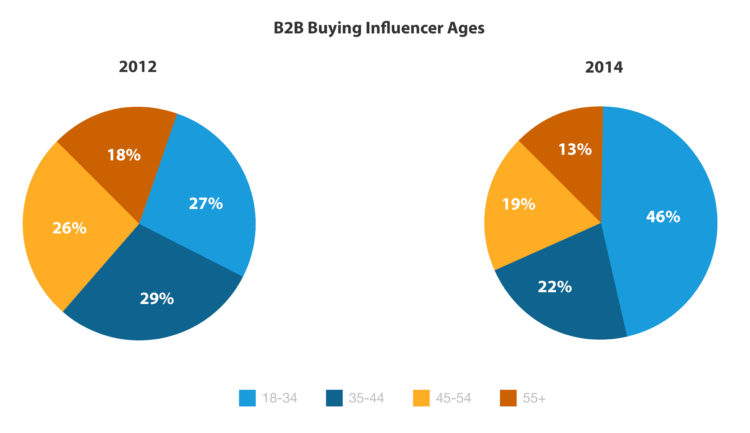

B2B

[Source: Google/Millward Brown Digital, B2B Path to Purchase Study, 2014]

In a short two years, millennials went from comprising about a quarter to almost a half of influencers involved in buying decisions in the workforce. This suggests that businesses should be paying close attention to their employees of this generation – especially when it comes to fintech. in 2016 PcW’s Global Fintech Survey found that:

- 53% feel an increase in customer churn is a threat impacting the rise of fintech

- 59% said loss of market share was another big threat

- 57% felt fintech was an opportunity to improve customer retention of customers

- 42% felt fintech can impact their business most by enhancing interactions and building trusted relationships with customers

CONCLUSION

Millennials live in a hyper-connected world where the electronic devices they carry with them daily are the newest and best avenues for your brand to reach them. They’re also much more trusting of brands when they find social validation and valuable content available.

In terms of both adaption and loyalty, behaviors of millennials differ from those of older generations; this requires going beyond traditional or foundational digital marketing activities, and thinking outside-the-box with channels and messaging that are dynamic and mobile.

Even more evident is the inherent need to get and keep your brand in front of millennials, rewarding them as customers and motivating them as brand ambassadors.

As well as being a rapidly growing and highly adaptable consumer audience, millennials are also increasingly becoming key influencers in businesses marketing fintech solutions to other businesses, and invaluable resources for marketers.