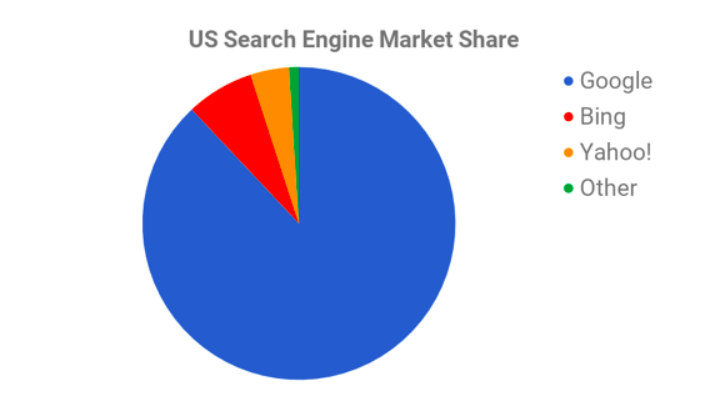

We’ve all seen the statistics about the traffic breakout between Google, Bing, and the others. Each report states basically the same thing, that Google owns the market share with anywhere from 80%-90% of traffic, while Bing and Yahoo fill in most of the rest. Knowing that Google makes up the lion’s share of search traffic makes it easy to forget about the “little guys” like Bing. Why bother having to copy, monitor, and optimize paid search campaigns on an entirely different platform? Wouldn’t that just be twice the work for a very small return? If your budget is minimal and using an ad management platform is out of the question, the answer might be yes. However, if budget allows you to achieve a significant impression share within Google, Bing should be your next step.

Here at Envisionit, we’ve seen Bing pay big dividends, most notably with our client Choose Chicago. Choose Chicago is the destination marketing organization for Chicago, Illinois. Its mission is to bring regional, national and international business and leisure visitors to Chicago for the economic benefit of the City, the community and its membership. Naturally, it’s a fun account to work on for a bunch of Chicagoans. Who wouldn’t want to help promote the city they live in and love?

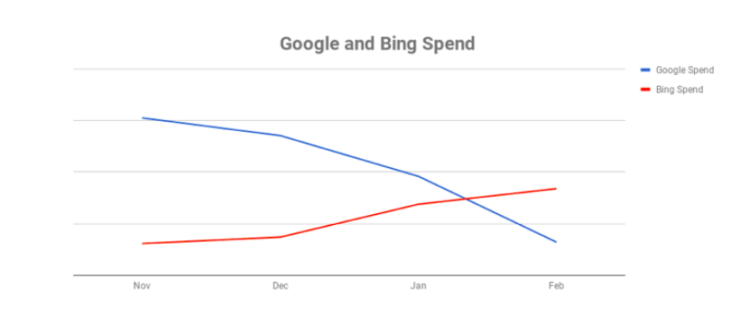

During the Fall of 2017, cost per acquisition (CPA) within Google had been rising consistently, while less funded campaigns within Bing saw positive but less consistent performance. The question we posed was this: could a shift in budget as well as optimization focus to Bing, which had far less volume, produce conversions more efficiently but still at a relevant level?

We started the test by shifting budget towards campaigns within Bing at a high level, examining where it would perform best. This provided us a great deal of worthwhile data, which we used to expand upon keywords, copy, and match types, making shifts where necessary.

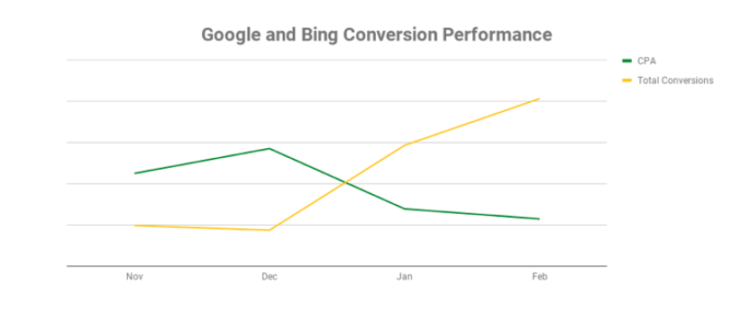

Initially, performance varied across campaigns, which we expected. As we shifted budget towards Bing, CPA increased 26% while our total conversions fell 11%. The upside—this was buying us data into exactly what worked and what didn’t in comparison to Google. We gathered insights into ad copy performance, keyword strength, and especially how there was more volume than the Bing engine previously suggested.

This data proved to be worth the cost and gave us the information we needed to target only the campaigns with top-tier performance. Through February, CPA decreased 49% while total conversions rose 125% compared with the previous four-month average. March saw further improvement in total conversions as we expanded campaigns to cast an even wider net.

Beyond the improvement in leading KPIs, Bing data has also given us understanding of the type of audience that is most likely to convert on the campaigns goals. Using this information holistically across channels is helping further justify the shift towards Bing.

Will Bing provide the type of value across every campaign? Surely not. But when the budget allows, it should definitely be tested. If you’re already using an ad management platform to make optimizations, you really don’t have an excuse not to dip your toe in the water. It’s inherently a different audience that might help you drive your most important KPIs while helping you better understand exactly who your customers are. The 5%-10% of traffic made up by Bing can have a bigger impact than you would think.