Millions of Millennials

The Millennial generation—also known as Generation Y—includes people born between 1980 and 2000. Most are now in the workforce. There are about 81m Millennials in the US—more than a quarter of the total population, and they now outnumber Baby Boomers.

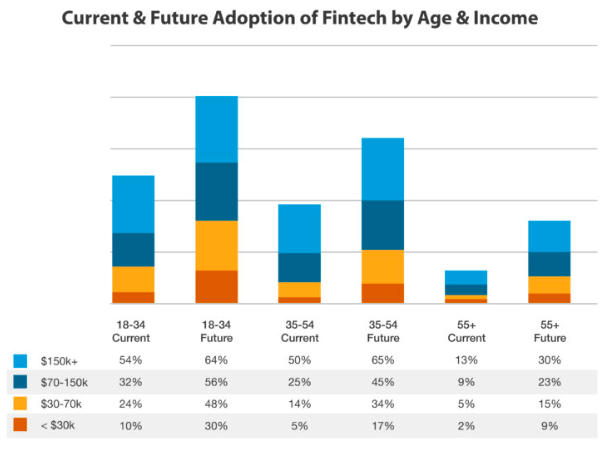

The good news for fintech is that Millennials tend to share the same lack of patience with legacy systems and, unlike other generations, expect technology to help them navigate complex financial decisions. In other words they are the perfect fintech customers, and the fight to cut through the noise and connect with them is on.

Reaching hyper-connected Millennials – beyond basic marketing strategies

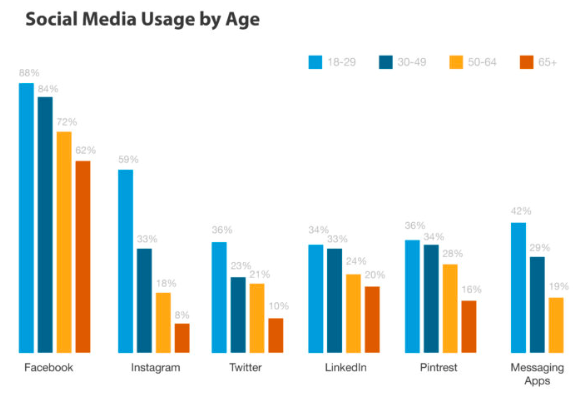

Millenials are hyper-connected: disproportionately drawn to mobile and wearable devices for their day-to-day needs; far more likely to make purchases on them instead of desktop computers or in-person; and they are constant users of social media.

This creates opportunities for marketing efforts that go beyond more traditional digital marketing channels like paid search and SEO to reach Millennials on the devices they take with them everywhere, every day.

Consider Venmo: The premier money transferring platform with a social component that allows people to quickly pay friends and family.

Founded in 2009, Venmo was the first to integrate a personal/social component to making payments. This mobile app quickly struck a resonant chord with Millennials, allowing them to settle up on things like rent, bar tabs, and dinners in a way that was most reflective of and inherent in their everyday activities.

Through social media and social sharing, Venmo caught on like wildfire and is now actually used as verb to describe paybacks: “I’ll Venmo you later.” This payments platform juggernaut caught all the biggest banks by surprise, completely catching them off guard and having to spend billions to catch up.

Scratch’s 2017 Millennial Disruption Index reveals that Millennials see more change on the way.

- 68% say that in 5 years, the way we access our money will be totally different

- 70% say that in 5 years, the way we pay for things will be totally different

- 73% would be more excited about a new offering in financial services from Google, Amazon, Apple, Paypal or Square than from their own nationwide bank

- 33% believe they won’t need a bank at all in 5 years

Challenges of marketing fintech solutions

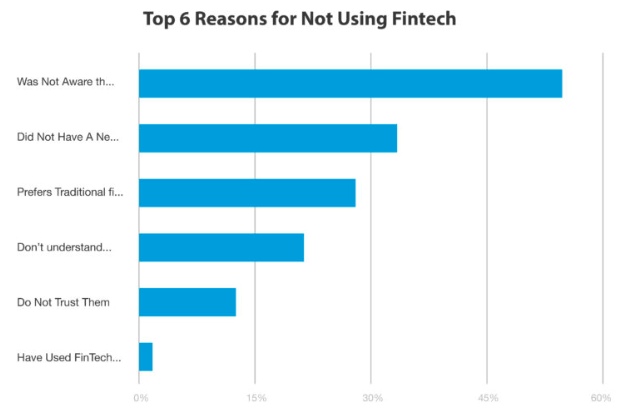

The greatest obstacle for fintech companies to reach millenials is lack of awareness about their brand and technology (see below). Fintech companies need to invest in building their brand and driving product awareness to overcome this. Only then can they help their audiences understand and desire the benefits they can offer.

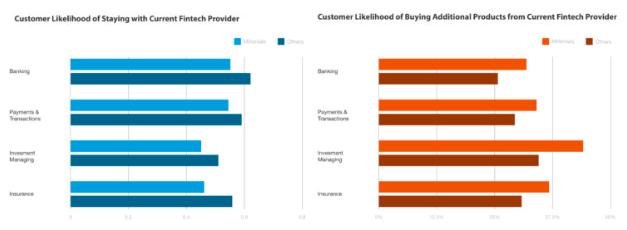

Although less likely than other generations to stay with their current fintech brands, Millennials are more likely to buy additional products from them. This suggests that while product awareness and information are important for top-funnel marketing efforts, lead nurturing, community management, and content marketing will be increasingly important for bottom-funnel marketing efforts.

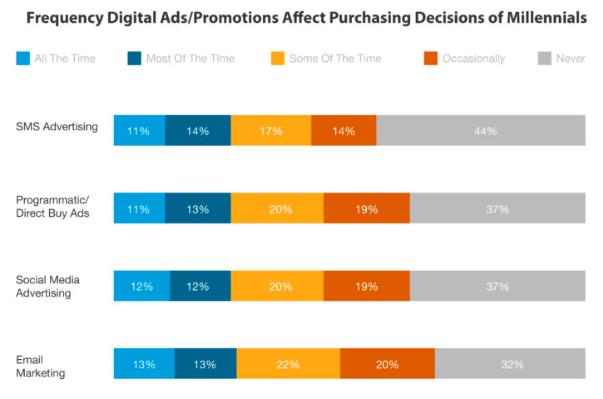

Millennials’ purchasing decisions are heavily influenced by non-traditional, modern digital marketing tactics. The survey found that:

- 66% are affected by SMS ads

- 63% are affected by social ads

- 68% remain influenced by email

- 66% remain influenced by programmatic and direct buy ads

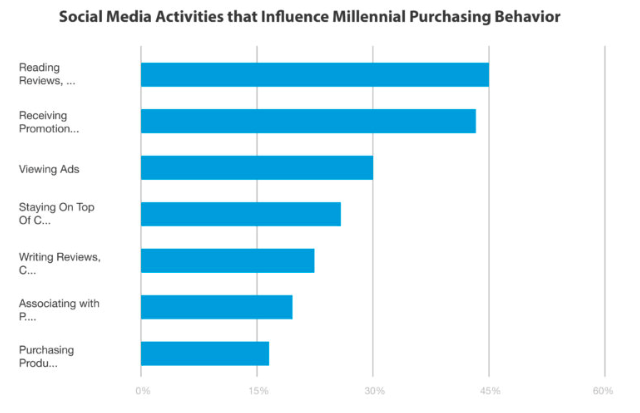

A combination of advertising, promotions, and online community has a strong influence on Millennials’ purchasing behavior. Although awareness and lead generation campaigns can still be effective, Millennials also look for reviews, comments, and other content that will help them trust the brand.

Cracking the Millennial code

Millennials live in a hyper-connected world. Their mobile devices are the newest and best avenues for your brand to reach them. They’re also much more trusting of brands when they find social validation and valuable content available.

It’s critical to get and keep your brand in front of Millennials in environments that seem natural (marketing that doesn’t feel like marketing), and to reward them as customers and motivate them as brand ambassadors. It requires creative thinking. There’s no easy button, but the reward is too great to ignore.