Marketing for a fintech can be… challenging. But there are distinct growth opportunities in each obstacle.

If you had the choice to run marketing for a product that helps businesses use digital currencies and public blockchains for payments OR let’s say … gum … which would you choose?

If you’re up for the challenge to market a fintech, you’ve come to the right place. We at Envisionit are borderline obsessed with following the industry, mastering the categories and building digital marketing programs that help financial tech brands grow and scale.

And yet … we know firsthand how mentally taxing it can be to position these complicated solutions. Just when you think basic customer acquisition will solve all of your growth problems, or that the only way to stand out among the sea of competitors is to put all of your media dollars in one attention grabbing basket – that’s where wicked smart strategy becomes critical. And it starts with clearly defining your biggest roadblocks and your biggest advantages.

On episode 5 of The Fintech Marketing Strategy Hour podcast, we talk to Director of Digital Solutions for Envisionit Fintech Marketing, Brian Ryback. Brian not only takes us through three of the biggest brain busters in marketing for fintech products and services today, but he also gives us very specific actions to take if you’re neck deep in your feelings with these obstacles.

We’re sharing the high-level challenges and respective actions to take right here. Be sure to tune into the podcast to hear all of the additional tips and explanations for each.

Fintech Marketing Challenge 1: Not All Customers Are Created Equal

It’s not simply about getting signups for your platform. You want customers who make frequent transactions. Payments companies, for example, have their revenue models tied to transaction volume. So active customers aren’t just a nice to have – it’s how these platforms run their businesses and make their money. It’s critical to keep that transacting persona top of mind in everything you do.

Make it an opportunity: Find the right-fit customer with Mindset Marketing

Fintech marketers need to go beyond basic demographics and psychographics when creating their ideal customer profiles. The additional lens needed is an understanding of a potential customer’s mindset. You need to relate to the ones who will transact, so your targeting and messaging shifts based on this intel.

Here are some resources to help you consider the thought processes and motivations behind your ICP’s decisions:

Mindset Marketing Resources:

- Podcast: Episode 2 of the Fintech Marketing Strategy Hour podcast, “Maximize Your Fintech Marketing Investment with a Customer Mindset Strategy.”

- Blog: “How to Use Customer Mindset to Maximize Your Fintech Marketing Investment.”

Fintech Marketing Challenge 2: Standing Out in a Crowded Market

You can feel it. New competitors are joining the buzzing fintech boom every. single. day. Even tougher, in the cases where there is a platform, you have competitors on individual functions. For example, if you’re doing payouts AND card issuing, you’ll have competitors who do both, and competitors who do one or the other.

Make it an opportunity: Clearly define your strengths, competition and voice

- Strengths: Get crystal clear on your offer and which problem your solution is the best at solving. Double down on that strength and reiterate what you’re best at in your messaging at key points in your buyer’s journey.

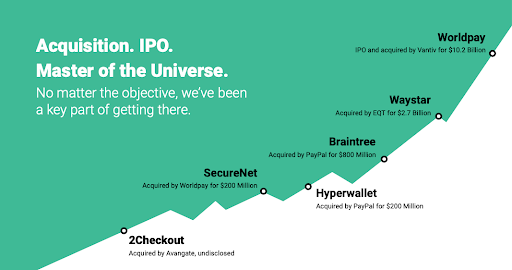

- Competition: Perform a competitive landscape analysis to determine where you shine. At Envisionit, we look at our clients’ competitors in every facet: what channels are they running, what are they saying on their website, how are they positioning themselves in their creative, etc. Listen to episode 5 of the Fintech Marketing Strategy Hour Podcast to hear about the conquest campaign we ran for Braintree.

- Voice: In a world full of memes and abbrevs, it’s critical to find (and stick to) your voice and tone. Catchy creative helps you stand out, and gets people to take a second look at your ads or content. Episode 5 also references how we pushed the envelop when targeting a skeptical audience: developers.

Fintech Marketing Challenge 3: The Need for Speed

Every industry has their own unique set of challenges. But to us, fintech is special breed, and one of the single differentiators in the fintech space is SPEED. There are dollars constantly flowing. VC/PE deals need to be made quickly. Expectations from leadership change overnight. Results are needed quicker than ever. Bottom line: fintech marketers feel the brunt of it as they need to be quick on their feet and nimble to adapt with the high-pressure changes.

Make it an opportunity: Alignment internally & externally

- Internally: Aligning with leadership on a specific outcome and tangible impact should be your very first step. If you don’t know the business goals, how will you know which marketing efforts to run? Your marketing strategy should be custom designed to achieve the annual and three-year goals for the business.

- Externally: Partner with an agency. It’s hard to find an individual with both marketing AND fintech experience. Envisionit comes with batteries included. It may be at a premium over the product marketer you considered hiring, but our expertise and results more than make up for it. Let’s talk fintech marketing agency perks:

- BIGGER TEAM: Instead of fighting for a few in-house FTEs, fight for a fully equipped crew of digital marketing geniuses who have a proven track record of demand gen, lead gen and customer acquisition for fintech brands.

- UNIQUE ABILITIES: One of the biggest benefits of working with an entire group of individual specialists rather than a few generalists is that each member of the crew has her/his own area of expertise. From brand messaging & graphic design, to web development & website copywriting, to paid search & search engine optimization … these are just a handful of the highly specialized abilities that our Envisionit Mates have.

- MEDIA MASTERY: If you want to become a scaled up brand, you need to perform like a scaled up brand. What do we mean? What got you here won’t get you there. Organic marketing alone will not set you up for outstanding valuation – nor will a few thousand dollars a month in digital ads. You need a sophisticated and substantial media strategy that predicts performance and doesn’t waste one dime of your marketing investment.

Wrap Up

We know what it’s like to navigate the torrential waters of fintech marketing because we’re all fintech marketers over here at Envisionit. Attracting customers that actually transact, creating content your ICP actually reads, getting quick results that actually grow your business – this is our life’s work.

To absorb more best practices, case studies, templates and conversations all dedicated to the art of successfully marketing fintech products, read through our blog and tune into the Fintech Marketing Strategy Hour podcast.

If you’re ready to talk through what’s working and not working in your fintech marketing strategy now, contact us here and we’ll follow up to book a quick call.