What makes a solid fintech marketer? Grab our checklist and see how you line up.

Marketing B2B fintech brands is like Leonardo DiCaprio navigating story plots in Inception: it’s a niche within a niche.

And while you may support the motto that “the riches are in the niches,” you might also feel frustrated, wondering why your typical B2B marketing strategies aren’t generating the results you’d hoped for in your fintech campaigns.

We at Envisionit have listened closely to the struggles and successes of dozens of fintech marketers. We’ve seen firsthand the qualities possessed by the ones who come out on top. So, in alignment with our proprietary mindset marketing strategy, we decided to conduct some internal research among our most successful performance marketing programs in the fintech sector and uncovered the top 10 traits carried by the teams with the strongest growth.

Interested in hearing what those traits are and discerning whether you possess these qualities as well? Read on to find out.

Top 10 Traits for Smart Fintech Marketing

1. Wise with Words: Use shared language rather than inside-baseball

Problem: Many fintech companies are developing entirely new categories of products and services. It’s challenging to determine what your buyer personas and ICPs think about your product or service and how they’re searching for them when there’s no shared vocabulary.

Solution: It’s important to gather plenty of search data before you start your campaign to make sure you’re using the right language. Many organizations fall into the trap of extending internal language – which isn’t understood the same way externally – to talk about and classify their solutions. Instead, do your pre-launch research to determine which words and phrases will resonate most with your audience. Keep testing these terms and the engagements they create.

2. Empathetic: Feel their pain with community listening

Problem: Simply assuming you know your ICP’s struggles won’t get your audience saying, “Wow, they get me!” On top of that, a pain point they may have might sound trivial to you, but it can potentially snowball into a major issue for them down the road.

Solution: Follow along in conversations both in social channels as well as “dark social” environments like communities and Slack channels where your ICP participates. Listen to what they’re trying to accomplish and their concerns around it.

Bonus Points: Pay attention to aspects of your competitors’ products that are generating complaints. Or, there may even be products that people bemoan the loss of on social channels like Twitter. Get the advantage by addressing these needs and challenges head on. Genuinely listening (whether it be through social, surveys, sales calls or Slack) can turn up a lot of fertile ground.

3. Discerning Qualifier: Appropriately score your leads, and send them the right messages

Problem: Many fintech marketers don’t consider the complete buying phase of their ICP. How does a prospective customer behave early in the path to purchase? What about later?

Solution: Map out these points and document them so you can nurture your contacts along in a coordinated fashion (sales and marketing teams unite!). If your sales team says they don’t need data or that they use their “gut,” tell them gut instincts are developed over time with data, and then wink. ; )

Make sure your agency stays tethered to what a high-value lead and the lifetime value of a lead look like. A scorecard that explains how leads are qualified and scored should be universally recognized. Everyone should have access to the insights, which should be formatted in a way that’s easy to use (we’re side-eyeing you, data dumpers).

4. Specific: Speak directly to your Ideal Customer Profile

Problem: In today’s hurried world, it can be tempting to fall into the trap of consolidating all of your personas into one general category in your messaging. Truth is – when you try to speak to everyone, no one hears you. Remember, you want your specific ICP to say, “Wow, they get me!” Not, “Nope, that’s not me.”

Solution: Creating great, painless experiences for users should be a guiding mantra for all industries, especially fintech. Identify your target users and tailor your solution to them. We created a helpful template inside this article on building better fintech buyer personas.

Bonus Points: Automated experiences like chatbots or other forms of AI are a great place to start. It should feel human, however, even when it’s not.

5. A Problem Solver: Lead with how you help, save features for later

Problem: It can be easy to get lost in technical details and features of your solution. You might be so excited and proud of the cool new updates or the intuitive UX. But by leading with messaging in your fintech marketing, you likely won’t capture the attention of your audience right away – which is when you need their attention most.

Solution: Don’t lose sight of the big picture – the benefits that your technology brings to people’s lives. Your ICP needs to know what your technology is going to do for them. And the story starts by defining your solution in the context of the problems they face and how you’re going to solve them. When it’s time to dive deeper in a white paper or longer-form content, then you can nerd out on all the cool details.

6. Versatile: For case studies, it’s smart to think outside the vertical

Problem: Let’s say you designed a solution for an automotive client that demonstrates your ability to solve a similar problem for a different client in the financial technology space. Only thing is, you believe your prospect will want fintech-only examples, so you leave out the cool auto case.

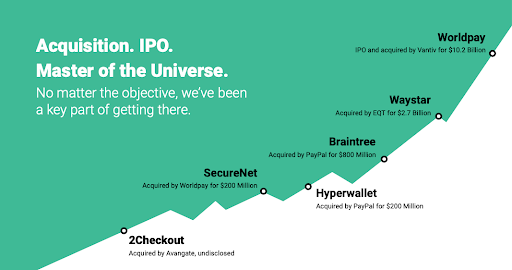

Solution: Believe it or not, it’s actually smart to bring outside-the-vertical case studies (like this one) to prospective clients in completely different industries. The important thing is you can demonstrate that you understand the problem they’re trying to solve, and you have proof that you can solve it.

7. Curious Techspert: Become a power user of your tech stack

Problem: If you’re already using marketing automation technology to run your email program, you may or may not have the capability to track leads by channel to conversion. Oftentimes, marketers don’t have this level of tracking set up, and end up missing out on super valuable data connections.

Solution: Instead, set up your marketing software to not only clearly see how your leads come in (from what channels), but also their lifecycle, and ultimately their conversion. This will essentially tie the lead back to the original channel.

Bonus Points: You can also sync your marketing automation platform with your CRM to make sure that all digital touchpoints are accounted for and understood by everyone — even sales. This level of insight allows you to fully understand how your marketing mix is working and adjust it accordingly.

8. Nimble Networker: Follow different paths to the decision maker

Problem: If Bob Barker taught us anything, it’s that the biggest prize of all might be behind door number three. If you only focus on the top two leaders in command, you’re missing out on VIPs at the account level. These contacts might understand your product much more in depth than the C-Suite, and can even set the stage for your potential high-level conversations later on.

Solution: Sometimes, the best way to reach the person who makes procurement decisions is through the back door. Generating interest with people who can influence the executives is sometimes the better opening.

Example: For a fintech client in the payment space, we at Envisionit have had a lot of success targeting our communication to the developers who would be integrating the APIs (our client’s solution) into their stack. We knew this segment was passionate about avoiding the pain points of poorly designed APIs, and that’s where we made our case. We also armed them with total cost of ownership and value proposition white papers they could bring to the C-Suite.

9. A Scientist: Test. Learn. Adapt.

Problem: Back to those times when you’re feeling rushed, it can be tempting to quickly piece together a campaign without basing it on any present or historic data and then hope for the best. You might also feel like throwing in the towel when a particular tactic wasn’t “successful” in your or your team’s eyes. “Back to the drawing board,” you may think. But not so fast …

Solution: Marketing is essentially a series of experiments. And the more you can test, learn and adapt across ads, thought leadership content, landing pages and email strategies, the closer you’ll get towards nailing down your go-to winning tactics. Work hard to understand what’s working and what’s not to refine messaging across audiences.

Example: Our proprietary approach at Envisionit provides clients with a hypothesis that helps them predict the outcomes of their channels. This allows for a more planful method with your media investment. Be sure to have smart benchmarks and goals confirmed within your fintech marketing strategy.

10. Persistent: Retargeting is worth the investment

Problem: When it comes to retargeting, brands either forget about this, don’t leave enough budget, or they don’t tailor their retargeting messaging based on the last page visited. This is a big missed opportunity.

Solution: Retargeting is inexpensive and can capture some very high value leads. Plain and simple: Don’t leave it off the menu.

Wrap up

Some of these fintech marketing traits may seem pretty evident to you, but you’d be surprised at how frequently even savvy marketers skip the actions listed here and miss out on opportunities to optimize their strategy and amplify their growth. The fintech space is volatile. Keeping a consistent and iterative campaign rolling will set you apart and bring you to your milestone.