In fintech marketing, platform differentiation is more important than ever.

At this point, I consider myself a fintech conference veteran. And, after I attend an event, I’m usually compelled to write my standard, post-event “Three Key Takeaways” article. But, 2024 is off to a different start. After checking out the exhibit halls and talking to a ton of great fintech organizations, there has been one thing that keeps standing out to me that I wanted to share.

Across the board, fintechs are evolving their product suites to increase stickiness with clients for longer-term relationships and more reliable revenue streams. While this tactic may potentially reduce instances of one-and-done interactions, it’s also ushering in an era where seemingly everyone will be a fractional competitor vying for diluted shares of an increasingly complex and convoluted market.

The legacy terminology in banking is “depth of wallet” — a customer with a deep wallet has significant financial assets and transactions flowing through their accounts. This could include savings, investments, loans, credit cards, and other banking products. Banks are interested in the depth of wallet of their customers because it indicates the potential for generating revenue through various fee-based services, interest income, and cross-selling opportunities.

That’s what fintechs are currently exploring. When they were simply processing payments, their competitors were just other processors. But by expanding capability and adding other features or product offerings, their list of competitors increases exponentially.

Differentiation is the key to successful fintech marketing

There are a lot of companies rubbing shoulders at exhibit halls who 1.) have similar product suites, 2.) maintain similar features, and most importantly 3.) are all selling their solution to the same audience. The fintech market is extremely competitive, and when your brand is literally right next to your competitor (at an exhibit, in the search results, or competing for the same mindshare), it’s clear the competitive landscape has reached a new apex. And growing fractional competition only broadens this challenge.

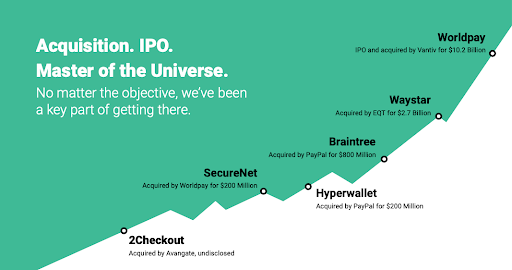

When the utility of online payments became a thing 20+ years ago and the PayPals of the world popped up, no one was immediately “hip to it.” It was very easy to stand out in the crowd because you were the only one (or two or three). Now, payment solution providers have hit the masses, proving utility in new, yet oftentimes the same ways.

This poses a big challenge for fintech marketers because as both direct competition and new players pop up every day, the need to differentiate only increases — even when there are fintechs who aren’t directly competing within the same vertical. It’s all part of the same noise that is occurring in the landscape. And by the time your potential client is going to the search engine looking for a solution that your company offers, it may be too late to stake your claim. At that point, your fintech solution is just lined up against everyone else’s and it becomes a commodity game.

The key to standing out is to get ahead of that search. You either need to outspend or outsmart the competition. We’ll assume that PayPal isn’t reading this (but if you are, hi!), so we’ll also assume that “let’s outspend the competition” will go over like a lead balloon with the powers that be.

Let’s focus on three organic, non-paid ways you can outsmart the competition and differentiate your fintech brand:

- Purpose: Your purpose needs to be clear. Why you exist, why you do what you do and what are the reasons to believe in your products and solutions. In fintech, a “sea of sameness” already exists in terms of colors and imagery, but that doesn’t mean you need to articulate your value propositions in the same way. You need to have a brand that stands apart from the competition and approaches the market with a fresh perspective and that means zeroing in on the utility your technology enables.

- Choose your descriptors intentionally: While I’ve attended these conferences, I’ve joked that you can walk around the exhibit hall floor and fill out a bingo card of fintech terms. In the payments space, it’s “omnichannel,” “seamless,” “frictionless,” “all-in-one” (the list could go on). These words aren’t bad in and of themselves, but absent of describing your unique purpose, and ultimately the value you deliver, you run the risk of swimming at the same end of the pool as everyone else.

- SEO & content marketing: We have an article that is purely dedicated to how you can leverage SEO and content marketing to differentiate yourself in the market! Spoiler alert! Everything from intent-based content, to customer feedback to tips to meeting Google’s E-E-A-T (Experience, Expertise, Authority, and Trustworthiness) guidelines will be covered!

If you’re curious to know how to break out from the crowd, let’s get in touch.